After a record 2025, Dubai and Abu Dhabi are entering 2026 with stronger fundamentals, clearer buyer intent, and a more long-term ownership mindset.

At The Ledger Homes, we’re seeing this shift directly: more clients are treating the UAE as a place to build their life and base, not just trade assets.

1) 2025 Set Records But the Details Matter

Dubai: record-breaking across the whole market

Dubai recorded its strongest year on record in 2025, with over 270,000 total real estate transactions worth AED 917 billion.

Dubai: residential-only also hit an all-time high

Within Dubai’s residential market specifically, Knight Frank reports 205,400 residential transactions in 2025 (an all-time high), with AED 544.2 billion in total residential sales value.

CBRE separately notes Dubai recorded over 206,000 residential transactions in 2025 (different methodology/coverage cut, but directionally aligned).

Abu Dhabi: strong growth with verified official figures

Abu Dhabi’s regulator (ADREC) reported AED 94 billion in total trading volume across 29,400 transactions in the first nine months of 2025, up 43.3% in value year-on-year.

And CBRE confirms Abu Dhabi’s residential sector delivered one of its strongest years on record, with transactions up 50% and values up 61% versus 2024.

2) Key Trends Shaping Dubai’s Residential Market

Premium and luxury demand is structurally strong

Dubai’s prime and ultra-prime segments continued to lead performance, with value growth outpacing volume growth—signaling a market increasingly driven by higher-value purchases rather than turnover alone.

Off-plan remains the dominant engine of activity

Off-plan sales continued to represent a major share of Dubai residential transactions, supporting price growth and keeping the market highly active.

Apartments drive volume; villas drive scarcity value

Apartments continue to account for most transactions due to wider supply and accessibility. Villas remain more supply-constrained, supporting stronger pricing power in lifestyle-led communities (a pattern consistently reflected in market commentary and pricing outcomes across major broker research).

Established communities still hold pricing power

Core locations with proven infrastructure and lifestyle depth—Downtown Dubai, Dubai Marina, Palm Jumeirah, and Dubai Hills Estate—continue to attract demand because they combine liquidity, end-user appeal, and long-term desirability. (This aligns with how prime demand is concentrated in Knight Frank’s residential performance narrative.)

3) Abu Dhabi: A Market Defined by End-User Strength

Transaction growth is being supported by confidence and transparency

ADREC’s data shows rising volumes and values, supported by regulatory initiatives and growing investor confidence in Abu Dhabi as a transparent market.

Apartments remain central; villas are a lifestyle upgrade play

CBRE reports strong residential momentum, with apartment performance leading growth and villa growth continuing at a different pace—consistent with a market where end-user demand and family living play a major role.

4) What This Means for Buyers and Investors in 2026

The UAE residential market is increasingly about quality of asset + quality of location + quality of intent.

In 2026, winning decisions will come from:

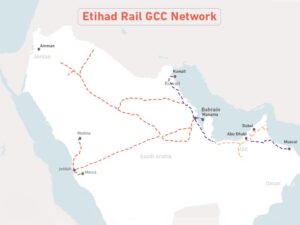

• buying in proven or emerging prime locations with long-term infrastructure logic

• prioritizing build quality, developer track record, and community maturity

• separating strategies clearly: yield-focused assets vs capital-preservation assets

Dubai and Abu Dhabi are now positioned as markets where real estate supports residency planning, wealth structuring, and long-term ownership not just short-cycle speculation.

At The Ledger Homes, we guide clients through this market with one goal: aligning each purchase with the right life plan and the right investment logic, backed by verified market data.